MCLR-Marginal Cost Lending Rate

Posted on March 24, 2017 / Written by Ajay Ruia Saakarfinserv.com - DSA Associate WhastLoan.com

Effective 1st April RBI has asked Banks to move from the Base Rate Model to the Marginal Cost Lending Rate (MCLR) Model. All Banks till 31st March were giving loans at Base Rate + Spread (loading Factor). Base Rate was basically the average cost of the funds to the Banks. On this they had a small BPS spread on various categories of loans based on the risk analysis. Hence you would find that the spread on the Base Rates for Home Loans was very low it was higher for car loans & much higher for personal loans.

Read More..Please note that Base Rates were not determined by RBI. It was an internal Bank rate based on the average cost of the funds to the Bank. Hence you would find the Base rates were slightly different for different Banks. The flaw in the Base Rate model was that it was based on Average Cost of funds which was not easily possible to calculate & hence customers felt that al the rate cuts by RBI were not being passed on to their home loans.

It was correct in a sense wherein Banks have existing Fixed Deposits which have been locked in for long term at say 9.00% or 9.50%. These deposits will mature in 2-3 years from now & hence the Banks will have to continue to pay higher rates to them and do not have the option of foreclosing the deposits unlike what a customer has on a Home loan. Hence the average cost of funds was being reduced over a longer period after RBI reduction in CRR / Repo rates. This lead to lot of heart burns amongst the customers who felt that RBI has announced 3 rate cuts of 0.25% but my Bank has not done so. The dynamic RBI Governor Raghuram Rajan who has brought in many sweeping changes in the Banking system like No Pre Closure Pre Payment Charges, Base Rate over the old PLR model (you can read in detail about these on the Banking System pages of this website) took notice of this customer discomfort & introduced the MCLR.

In this model the Banks will not calculate their loan rates on the average cost of funds but on the Marginal Cost of funds. MCLR reflects the cost of funds for a particular tenure. Hence if a Bank cuts its 1 year deposit (FD) rate by 0.25% from 1st April its 1 year MCLR will go down by a similar rate. The buyers who are taking fresh loans after this date will get the benefit of this reduced rate. The MCLR will be reviewed every month and changes if any will be announced on the Bank’s websites. The flipside of this model is that existing customers even in the MCLR regime will continue to pay the old rates till the reset date (once a year) after which their loans will be automatically reset to the new MCLR.

Leave a Comment:

PLR (BPLR) Vs Base Rate Model

Posted on March 24, 2017 / Written by Ajay Ruia Saakarfinserv.com - DSA Associate WhastLoan.com

In the old PLR model in place since 2003 we had Banks which had PLR of 11.50% some other had 12.50% and some had even 13.50 or 15.50%. From this there was a discount of 2 / 3 / 4 or 6% as the case may be to arrive at effective rates of 9.50%.

Read More..PLR was purely a Bank's internal rate & there was no basis or a common denominator. When the markets went up all Banks increased their PLR and all customers moved to the higher rates. The real game was played when the markets went down. If the Bank had to give a lower rates due to market conditions they smartly increased the discount on the PLR keeping the PLR at the old rates. Hence old customers were still at higher rates whereas the new customers got the reduced rates benefits.

On 1st July 2010 RBI asked all banks to move to the Base Rate model. In the Base Rate model although all Banks are still free to have their Base rates & it varies from 9.25% (Multinational Banks) to 9.50%. But please note that the difference between banks is not 2/3/4 % but mere 0.1% to 0.2%. Also a Base Rate by definition is the Base Minimum at which a Bank will lend to any customer (including Big Corporates). Hence there is a common denominator. If any Bank has to be in the market they have to be competitive & hence the max difference in Base rates between banks will be Plus (+) or minus (-) 0.25%.

Leave a Comment:

Fixed Rates - Not in My Interest !

Posted on March 24, 2017 / Written by Ajay Ruia Saakarfinserv.com - DSA Associate WhastLoan.com

Long Term Fixed Rates

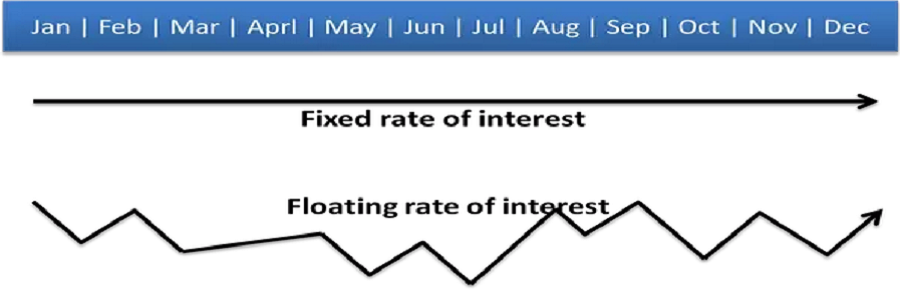

There are not long term fixed offers. Even if any Bank is giving 10 or 20 year fixed offer it is @ 10.75% - 11.25% which is impractical as you may never reach these rates. Hence it is better to enjoy the ups & downs movement of the rates than get stuck at higher rates for the full tenure.

Read More..These are being given at rates of 9.50% to 9.60% by some banks for 1 or 2 years. Please note that in the short term the rates are definitely moving only one way which is down. Hence there is no logic in tying up at 9.60% for 2 years when the rates may be 9.25% in 3 months & maybe 9.00% in the next 6-9 months.

Short term Fixed Rate-HFCsSome HFCs offer fixed which might look very attractive @ 9.50% or slightly lesser. Please note that after 2 years you will move to floating rates. You will have to be very careful with them and double check on the modus operandi on their floating model when the rate moves to floating. The floating after 2 years is PLR (around 14.00%) minus discount (around 2.50%). This means that after 2 years you will move to 11.50% floating rate.